Establishing a precise financial framework for classic furniture within high-end residential developments in the Gulf region requires distinct procurement strategies separate from standard fit-out estimations. In the luxury sector, specifically across the UAE, Saudi Arabia, and Qatar, Furniture, Fixtures, and Equipment (FF&E) budgets frequently exceed 40% of the total project value. Accurate budgeting demands a granular analysis of raw material sourcing, artisanal labor hours, freight logistics, and the specific import taxation structures of the Gulf Cooperation Council (GCC) states.

Baseline Budget Allocation: The FF&E Ratio

In premium residential projects, the “square meter” estimation method often fails due to the high variance in specification levels. A more accurate model isolates the furniture budget from the general construction contract.

| Category | Typical Allocation (%) | Primary Cost Variable |

|---|---|---|

| Hard Fit-Out (Flooring, Ceiling, MEP) | 35-40% | Material grade (e.g., Marble vs. Porcelain) |

| Loose Furniture & Joinery | 35-45% | Craftsmanship level, Solid wood volume |

| Soft Furnishings (Curtains, Rugs) | 10-15% | Fabric tier, Manual stitching |

| Logistics & Installation | 10-15% | Origin distance, Assembly complexity |

Cost Driver 1: Materiality and Structure

The core expense of classic furniture lies in the structural integrity of the frame. Unlike mass-produced items using MDF or particle board, brands like Modenese Furniture utilize solid beech or lime wood, which allows for deep carving without structural failure. The price differential between a solid wood frame and a veneered alternative can range from 200% to 300%.

Furthermore, the moisture content of the timber must be kiln-dried to specific levels (typically 8-12%) to withstand the arid climate of Riyadh or the humidity of Dubai. Failure to source properly seasoned wood results in cracking, necessitating costly replacements. This technical requirement adds a premium to the raw material procurement phase.

Cost Driver 2: The Economics of Finishing

Surface treatments represent a significant variable in the final invoice. The application of gold leaf is a labor-intensive process that directly impacts cost based on the karat weight and application technique.

- Gouache Gilding (Water Gilding): The most expensive and traditional method, using bole (clay) and 24k gold leaf. It allows for burnishing to a high shine. This can increase the unit cost of a piece by 40-60%.

- Mission Gilding (Oil Gilding): A faster process often used for architectural elements. It is less costly but lacks the depth and burnish capability of water gilding.

- Imitation Leaf (Dutch Metal): A copper-zinc alloy. While cost-effective, it oxidizes over time, making it unsuitable for heirloom-quality projects expected to last decades.

Cost Driver 3: Upholstery and Textiles

The fabric selection often dictates the aesthetic value but also drives the budget significantly. Sourcing authentic italian fabrics involves navigating a tier system where price per linear meter varies from €50 to over €500. High-end velvets, silks, and brocades require backing materials to ensure durability, especially when applied to carved seating.

For large majlis seating arrangements common in GCC residences, fabric consumption is substantial. Pattern matching on complex damasks increases waste factors by 20-30%, a calculation often missed in preliminary budgeting.

Logistics, Duties, and Import Taxes (GCC Specifics)

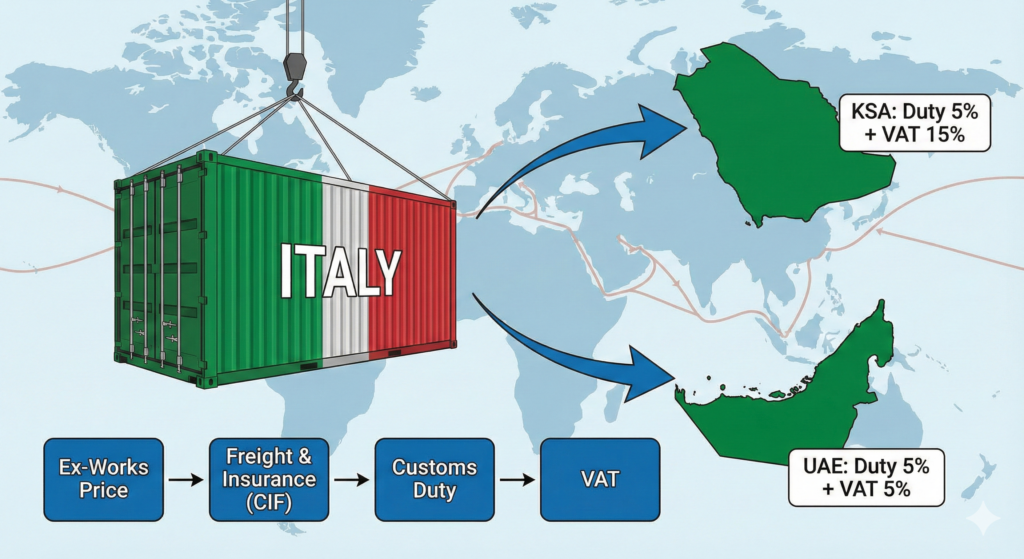

Procuring from Italian manufacturers requires a robust logistics budget. The total “landed cost” includes ex-works pricing plus freight, insurance, customs, and VAT. According to the International Trade Administration, the standard customs duty for furniture (HS Code 9403) in the GCC is typically 5% of the CIF (Cost, Insurance, and Freight) value.

VAT Implications

- Saudi Arabia (KSA): Since July 2020, the VAT rate is 15%. This applies to the total value of goods plus the customs duty.

- United Arab Emirates (UAE): The standard VAT rate remains at 5%.

For a project importing $500,000 worth of furniture into Riyadh, the tax burden (Duty + VAT) amounts to approximately $103,750, compared to roughly $51,250 for the same shipment to Dubai. This variance must be factored into the initial feasibility study.

Vendor Selection Strategy: Manufacturer vs. Reseller

Working directly with manufacturers mitigates “middleman inflation.” Retail showrooms typically apply markups ranging from 2.5x to 4x the factory gate price to cover inventory risks and showroom overheads. Engaging directly with producers like Modenese Furniture allows project managers to access trade pricing.

Direct procurement also enables “Value Engineering” (VE). If a quoted console table exceeds the budget, the manufacturer can suggest technical alterations—such as simplifying the carving depth or switching from marble to artistic glass tops—to reduce costs without compromising the visual footprint.

Risk Management and Inflation

Global shipping indices fluctuate. Budgeting for classic furniture must include a contingency of 5-10% for logistics volatility. Recent data from the World Trade Organization indicates that freight rates can spike unexpectedly due to geopolitical instability, affecting the final bottom line.

Additionally, lead times for bespoke Italian furniture average 12-16 weeks. Expediting production often incurs overtime surcharges of 15-20%. Proper project scheduling, aligned with the critical path of the site construction, prevents these avoidable costs.